When I first started my business, I often heard people say make sure you track your numbers for tax purposes. I would nod my head like I understood, but inside I was freaking out. I understood that I needed to track numbers, but what numbers do they need to be and do they need to be organized in a certain way?

What is most important to know?

Do I only need to track some things but not others?

I had no idea. So instead of doing anything, I just froze and did nothing — not my smartest move. Then, at the end of the year, I was back to spending hours sifting through business receipts and bank statements, trying to figure out those mysterious numbers I needed to rack.

I would get so annoyed and be so confused every time tax season came around, not sure if I was doing the right thing or finding the right numbers.

Eventually, I finally had enough, and I took the time to create a spreadsheet that not only tracked my numbers for tax purposes but also allowed me to see how my business was doing financially at any point of the year.

And now I’m going to walk you through the numbers you should be tracking throughout the year as well — so that you can set yourself up for a successful tax season.

A great starting point is understanding the different tax categories your expenses can fall into. So, I created a free guide for you. In this guide, I’ll walk you through the 15 most common tax write-off categories and what expenses fall under each of them. Plus, I’ll give you a few caveats for a few of these categories that you should know about.

The Basics of a Tax Prep Spreadsheet

Now, the first thing that I want to go over is setting up the basics of your tax prep spreadsheet. So, first off, what software should you use to create this spreadsheet? This is really up to you. You could use Excel or Google Sheets, whatever works best for your workflow. Now, I personally prefer Google Sheets because then I can access the spreadsheet anywhere at any time and not have to be reliant on having a hard drive to be able to update anything on my spreadsheet. Just makes it easier to know that if I need to input something right away so I don’t forget it, I easily can pull up my spreadsheet and add whatever it is.

Tax Prep Spreadsheet Structure

Now the next thing I want to go over is the structure of your spreadsheet.

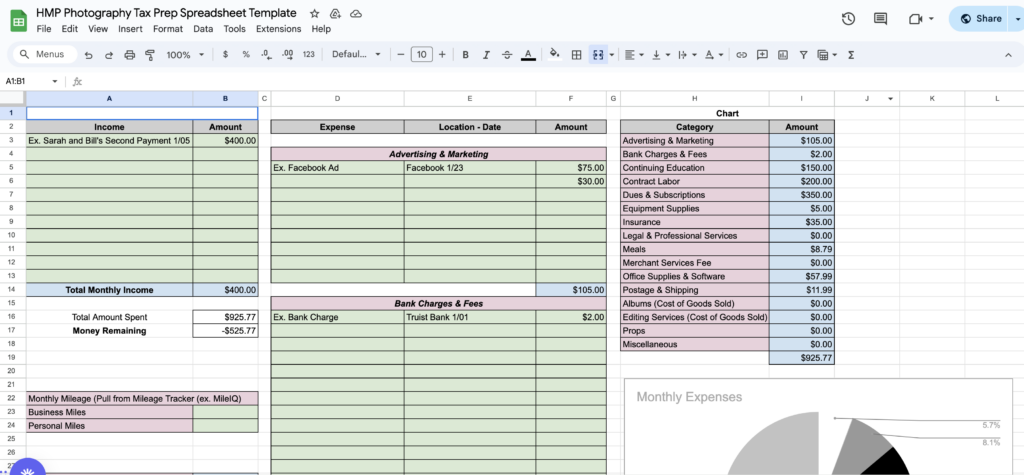

What should you be tracking? Some of the big things you want to make sure that you’re tracking are your income, your overall expenses, and then also a breakdown of your different deductions and what expenses fall under each of them. So, as you can see here in the image, I have the first two columns of the spreadsheet dedicated to income.

The next two columns are dedicated to expenses and then it also takes it a step further and breaks down the different deduction categories so that I can easily organize my expenses based on which category they fall under.

Now, the final column and area of this spreadsheet I’m going to talk about in a little bit, and we’re going to dive into some other things that you can use the spreadsheet for that can help you both in tax purposes, but also just in your business financially to know where it is at any given point.

Income Tracking in Your Tax Prep Spreadsheet

So let’s go ahead and dive into the income and what you should be tracking with your income. So, as you can see in this image I have two columns set aside for income. That is just so that I can track who it’s from and what the purpose was, so why they were paying me. And then the second column is the amount that they paid me. Now you could take this a step further if you want to and color coordinate the different types of income that you receive, whether it’s for a print sale or a client payment.

You could even break that out into weddings or seniors or families. That is totally up to you. I actually have a separate spreadsheet that I break all of that stuff out into. So this spreadsheet is really specifically dedicated to the income overall that I’m receiving. So in this spreadshee I just want to know how much I’m getting paid and what the purpose was so that I can get a total overall of how much income I made throughout the year.

No matter how you lay it out, you want to make sure you note who the payment is from, what it was for, and how much hit your bank account. Those are the most important things when it comes to your taxes and the numbers that you need to know.

Expenses Tracking

Now as we move over in the next three columns under the expenses section, you can see that I have a bank account broken out into separate, different gridded areas. This is so that I can not only track my expenses just in general for my business throughout the year, but I can also start categorizing them into the different types of deduction categories that have to do with your taxes.

Things like advertising or bank charges or education or travel costs, all of those categories that you can find in that freebie that I mentioned where you can see the most common 15 business tax categories.

That is how I laid out this section. I took those 15 most common ones, and then I added a coupl of other ones that were specific to my business and I broke them out so that as an expense comes in and I need to track it, I go into here and in the first column, I write down what it was for. In the second column, I write down who I paid it to and the date I made the payment.

And then finally, in the third column, I write down how much I paid. And so you can see that it’s going to total each of those different deduction categories on their own, and then also give me a total overall of my expenses for that month. This gives me the numbers that I need to send off to my accountant and CPA, but also it’s just letting me know where my business is financially and if I’m making a profit.

Analyzing and Summarizing Your Numbers

Now as you can see in the final column, that’s where I’ve taken things a step further in analyzing and summarizing the data that I’ve inputted for my income and expenses. I want to be able to easily see how much income I make per month and then how much I have remaining after expenses are taken out.

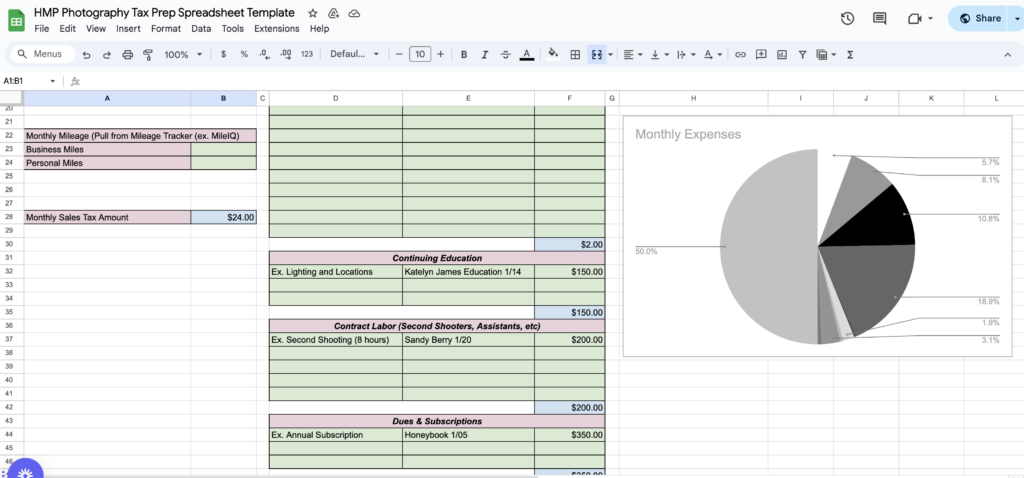

I want to see how much money I’m paying in each of the different expense categories. And I have that separated out into a pie chart so that if I feel like one of those pieces of the pie are bigger than what it should be,I can visually see it and then be able to make changes in my business throughout the year to help save my business money as we go.

This spreadsheet is more than just my tax prep spreadsheet. It helps me see my income and my expenses and total those numbers so that I can easily send them off to my accountant. But it also lets me just see where my business is financially at any given week. I highly recommend creating a spreadsheet where you’re tracking your income andyour expenses, and where you’re organizing those expenses into the different tax deduction categories so that you can easily send those totals off to your accountant.

And then if you’d like to take it a step further, create some different charts where you can analyze your expenses based on your income and also track your mileage and the sales tax that you owe.

QuickBooks is a great software that you can use that will track all of this stuff for you. It connects to your bank account so it easily can track and start organizing your numbers as soon as they hit the bank account. That’s something you could implement, but having a spreadsheet like this is all you need to make sure that you’re organized and ready for when tax season comes around, so you have your numbers prepared for your accountant or CPA.

The Tax Prep Spreadsheet

Oh, and this spreadsheet that you’re looking at is actually one that you can find in my shop. It’s the Tax Prep Spreadsheet. If you’re a little bit overwhelmed about creating spreadsheets and using Excel or Google Sheets, Take a deep breath — I’ve got you covered.

You can go ahead and grab this in the shop and it will already have all of this structure laid out for you. Not only does it have the structure that we’re going to reference, but it also is set up to calculate your totals for each deduction category per month and per year. Plus it’ll total up your income monthly and yearly and give you a pulse point on your business at any moment.

In addition to that, it also has space for you to track your mileage or take note of your sales tax that you’re going to owe for your business throughout the year. This is a spreadsheet already ready for use — all you need to do is when expenses or income come in, you’re making sure that you’re inputting it into this spreadsheet and you’re going to be ready to go for when tax season comes around.

Have questions about the Tax Prep Spreasheet? Ask away in the comments below!

Few things make me more excited than getting the chance to help another photographer prepare for an easier tax season. So, don’t forget to snag the 15 Business Tax Category Breakdowns.

Let’s Prep for Tax Season – Together

Make tracking your numbers easy with my Tax Prep Spreadsheet and ensure that tax season is a breeze.

Transform your passion into a thriving business and unlock success for your photography business with my free guide to setting goals for the first year of your photography business.

Want taxes to suck less? Learn how to correctly prepare your taxes for your accountant with the Photographer Tax Course – and say hello to a confident and calm tax season!

Don’t know what you don’t know? You’re just 90 minutes from a custom tax prep system with my 1:1 Tax Prep Mentoring sessions!

XOXO ~ Heather Marie

More HMP Blogs for Photographers:

+ COMMENTS

add a comment