I started my business with one financial principle — that I would grow my business without taking out any loans or going into debt.

Sure, I didn’t have the best camera starting out and I only shot with a 50mm at sessions, but I saved up and only spent the money to upgrade once I had the money in my business account. As small business owners, we are in charge of knowing where our business stands financially.

If we aren’t tracking our income and expenses, we could be spending more than we make — putting ourselves on an uphill climb and our businesses at risk. If we just look at our income as the notifications pop up on our phones, but don’t track where our money is going, we may end up in debt. It can be easy to just swipe the card, but that can turn into a vicious cycle quickly.

Not to mention, not knowing our expenses each month or even just each project could mean that we are not charging correctly for our time. We’re putting in the work and we deserve to be compensated for that. But if you’re just throwing prices out there and not looking at your expenses, then you may be missing out on the profit that you deserve.

Which is why today, I’m going to show you how to track where your business money is going and how to analyze those numbers in order to make changes.

And while we’re discussing expenses – it’s also important to know the different tax categories your expenses can fall into. So, I created a free guide for you. In this guide, I’ll walk you through the 15 most common tax write-off categories and what expenses fall under each of them. Plus, I’ll give you a few caveats for a few of these categories that you should know about.

Setting Up a Tracking System

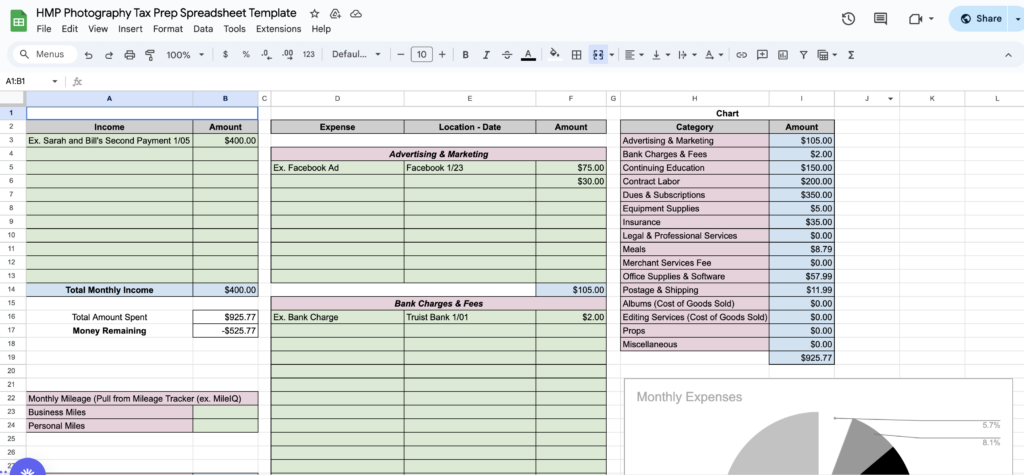

The first thing I want to go over is setting up a tracking system. You can either do this manually with a spreadsheet or with an accounting software. It just depends on if your business can financially afford to pay for the software monthly. I personally started out with a spreadsheet that I created for my first two years of business and then added on an accounting software later. For me specifically, it was QuickBooks after my business was bringing in more money and I was busier and needed to give up tasks.

Regardless of how you track, the two things that you need to make sure you’re tracking are your income and your expenses.

I recommend creating a section in your spreadsheet that is all about income. And then separately do a section that’s just for expenses. I’ve personally found that it’s easier to separate the two, but then at the bottom have a place to analyze and compare them. Doing it separately allows you to create a running list of your income and your expenses as you make and spend it.

Then, each time a new transaction shows up in your bank account, you’ll want to note it in your spreadsheet and make sure you track:

- What the money was for

- The date that it was spent or received

- The transaction amount

You can easily create an equation in the spreadsheet to total everything up, and also subtract your expenses from your income — giving you a total on what your profit is.

Creating a new sheet for each month with the same layout gives you a zoomed-in look at your business monthly and then also you can compare it yearly.

When it comes to your expenses, I would create a subsection under the expenses section so that you can start organizing your expenses for tax purposes. Remember that freebie I mentioned about the most common tax categories? Those will come into play here.

Make sure the spreadsheet is set up so that it can total each of these categories individually, as well as overall, and then yearly based on each of those months.

This makes it easy to grab those totals for your accountant or CPA and send them off at the end of the year. If setting up a spreadsheet makes your heart race, then take a deep breath. I’ve created a spreadsheet template for you. This spreadsheet will not only get your numbers ready for tax season, but it will also allow you to see your profit and loss for each month and overall for the year.

Analyzing Your Spending

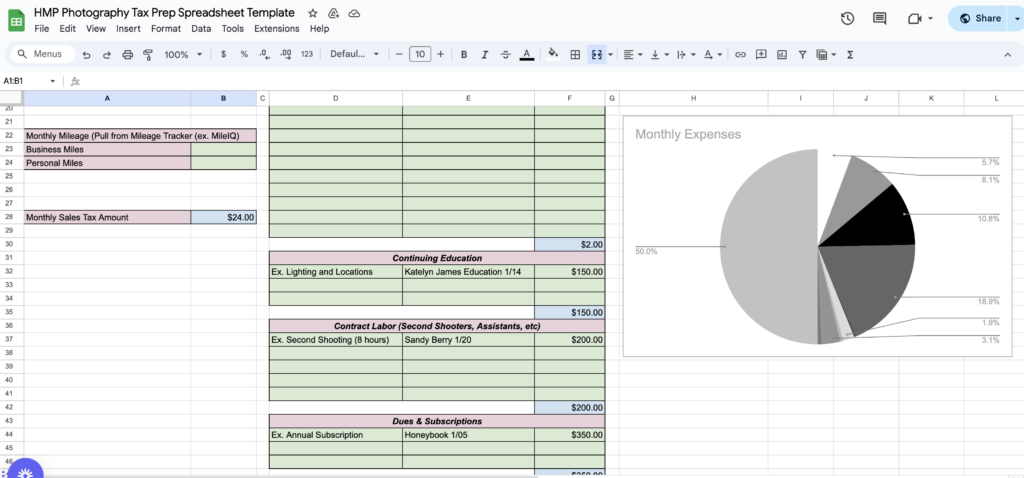

Now that you have your tracking system set up, let’s talk about how to analyze your spending. With the different expense categories created, you can now compare them with each other.

Spreadsheets make it really easy to create a real-time pie chart so you can see the percentage you have spent for each of these categories at any time you add an expense. The pie chart makes it really easy to visualize where your money is going overall. Once you know that, you can start figuring out if too much is going to a certain category.

Maybe you’re spending too much on education or equipment and you need to slow down. It can be easy to want the new shiny thing that someone else has, but if you’re not at the point of making as much as they are, then you may need to save up for that piece of equipment instead of going into debt for it.

Or maybe you’re spending a lot on ads. If you’re not seeing a positive return on investment, then maybe it’s time for you to reduce that spending or stop it altogether and try a new marketing strategy.

Or maybe it’s that you realize that you’re not charging enough in your packages because the expenses that go with each client are more than you realize, and you’re not paying yourself enough for your time.

Keeping your income and expenses up to date allows you to see if your business is financially healthy. It also shows you where you may be spending money that you didn’t realize, such as software that you don’t use anymore, but are still paying for. Identifying these expenses and eliminating them allows you to have a larger profit at the end of the year.

And lastly, it saves you time for tax season. With this tracking system, your numbers are ready to be shared with your accountant and you don’t have to scramble to gather everything when March comes around. So I encourage you to set up a tracking system and analyze it each month. This allows you to stay up to date on your finances so you can always know where your business is.

And if you want to keep more of what you earn in your business, join me for a free class — Maximizing Your Tax Deductions as a Photographer.

Give me an hour of your time, and I can show you:

➡️How to reduce your tax liability and improve your cash flow with tax deductions.

➡️The 5 key deductions every photographer needs to know about (and should probably be using).

➡️What qualifies for these deductions, and what doesn’t.

➡️How to calculate the deductions that aren’t simple and straightforward.

Last year, I saved $12,817 just by utilizing the 5 key deductions I’m going to be sharing with you, so this is a class you won’t want to miss!

Have questions about tracking your business income and expenses? Ask away in the comments below!

Few things make me more excited than getting the chance to help another photographer prepare for an easier tax season. So, don’t forget to snag the guide on categorizing your expenses – 15 Business Tax Category Breakdowns.

Let’s Prep for Tax Season – Together

Keep more of what you make inside of your business with these 5 key deductions for photographers. I’m sharing all inside of my free class — Maximizing Your Tax Deductions as a Photographer!

Make tracking your numbers easy with my Tax Prep Spreadsheet and ensure that tax season is a breeze.

Transform your passion into a thriving business and unlock success for your photography business with my free guide to setting goals for the first year of your photography business.

Want taxes to suck less? Learn how to correctly prepare your taxes for your accountant with the Photographer Tax Course – and say hello to a confident and calm tax season!

Don’t know what you don’t know? You’re just 90 minutes from a custom tax prep system with my 1:1 Tax Prep Mentoring sessions!

XOXO ~ Heather Marie

More Tax Tips for Photographers:

Automate Your Bookkeeping: Spend Minutes, Not Hours Taming Your Finances

+ COMMENTS

add a comment